straight life policy term

Straight life policy term. Terms range between 1 year and 30 years depending on the plan offered by the.

What Is A Ppo Preferred Provider Organization Part 2 Types Of Health Insurance Dental Insurance Plans Health Insurance Plans

Ad Get Instantly Matched with Your Ideal Life Insurance Policy.

. Compare 2022s Best Options. A life insurance policy that provides coverage only for a certain period of time. It will remain the same for the new 5-year term.

Shop The Best Rates From National Providers. A straight life insurance policy provides coverage for a lifetime with constant premiums throughout the policys term. Straight Whole Life Insuranceor ordinary life provides permanent level protection with level premiums from the time the policy is issued until the insureds death.

A man decided to purchase a 100000 Annually Renewable Term Life policy to. Also known as whole or ordinary life insurance the policy has a term length that lasts your entire life. As with all whole life.

SelectQuote Rated 1 Term Life Sales Agency. This traditional life insurance is sometimes also known as. Ad Find The Greatest Coverage For The Lowest Premium.

Ad SBLI Has Been Protecting Families For Over 110 Years. Policy riders to protect your loved ones. Get A Life Insurance Quote Online Now.

What is Straight Life Insurance. International Risk Management Institute Inc. Decreasing Term - A decreasing term policys face amount decreases as the amount of debt is reduced.

See Your Rate and Apply Online. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit. Decreasing term insurance is a type of annual renewable term life insurance that provides a death benefit that decreases at a predetermined rate over the life of the policy.

It is also known as ordinary life insurance. Most term life insurance policies offer a level death benefit. Allow Us To Guide You Through The Process And Help You Make The Right Decisions For You.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. Reviews Trusted by 45000000. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or a death benefit.

It is also known as whole life insurance. Find the Best Rates Quotes for Life Insurance Policies Using Our Chart. Straight Life Policy an ordinary life policy or whole life policy.

12222 Merit Drive Suite 1600 Dallas TX 75251-2266 972 960-7693 800 827-4242. A straight life insurance policy is a type of permanent insurance that provides a guaranteed death benefit and has fixed premiums. A straight life insurance policy provides lifelong coverage at a consistent premium rate.

A straight term insurance policy provides a benefit upon the death of the policyholder but ceases to provide. A straight life annuity sometimes called a straight life policy is a retirement income product that pays a benefit until death but forgoes any further beneficiary payments or. A straight life insurance policy often known as whole life insurance.

Ad Compare 2022s Best Life Insurance Providers. It will decrease for the new 5-year term since the insured is now a lesser risk to the company Which of the following is an example of a. Apply Online In Just Minutes.

While straight life insurance offers lifelong coverage term life insurance provides temporary life insurance coverage.

What Is A Straight Life Policy Bankrate

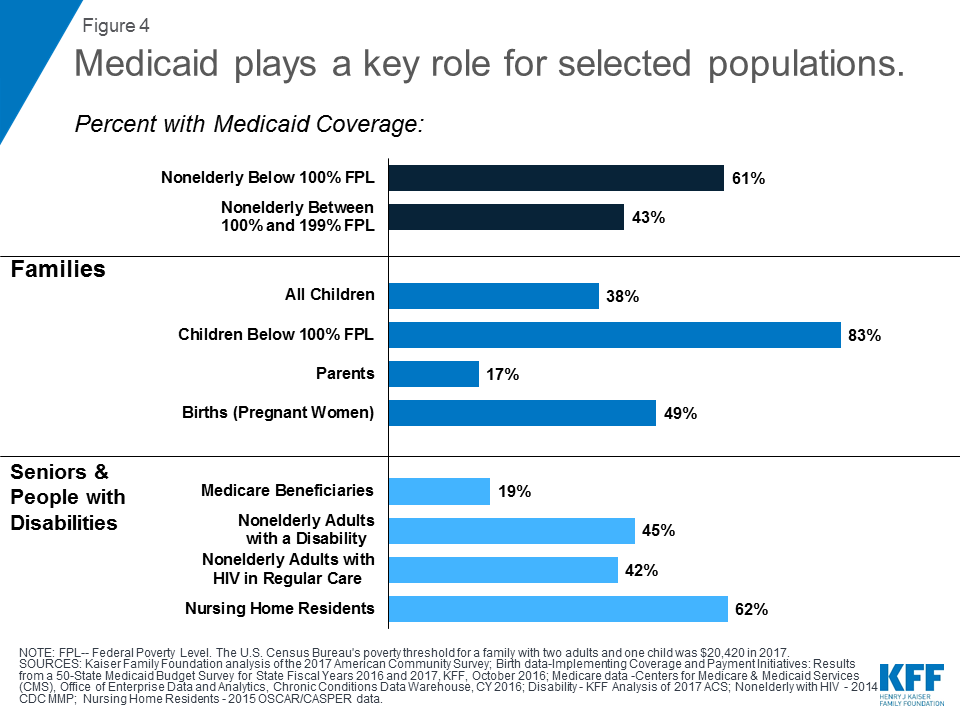

10 Things To Know About Medicaid Setting The Facts Straight Kff

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

The 7 Types Of Life Insurance Policies What S The Best One For You

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

What Is A Straight Life Policy Bankrate

Straight Line Equations Definition Properties Examples

/GettyImages-1134608493-a72c93c4adc34ee3b5a1c6e54dffa379.jpg)

Whole Life Insurance Definition How It Works With Examples

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

What Is Whole Life Insurance And How Does It Work Lincoln Heritage

The 7 Types Of Life Insurance Policies What S The Best One For You

Term Vs Whole Life Insurance Differences Pros Cons Nerdwallet

/StraightLineBasis-bfb937d99f9d49ac9a15b8f78ca3b1a0.jpg)

Straight Line Basis Calculation Explained With Example

The 7 Types Of Life Insurance Policies What S The Best One For You

The 7 Types Of Life Insurance Policies What S The Best One For You

:max_bytes(150000):strip_icc()/Term-a-annuity_Final-22818c662b274f2c82716dd2184f06c9.png)

:max_bytes(150000):strip_icc()/straight-line-depreciation-method-357598-Final-5c890976c9e77c00010c22d2.png)