starting credit score usa

A Secured Card With No Annual Fee. Credit scores which are like a grade for.

What Is The Average Credit Score In America Credit Com

Building a good credit score takes time and a history of on-time payments.

. Regardless of your age those who are initially building their credit score can start from 500 to 700 with those in their 20s having an average score of 660. 76 and older. New credit applications typically require a hard credit check which can ding your credit score by up to five points.

Apply for a better credit card. Responsible Card Use May Help You Build Up Fair or Average Credit. Youve managed your bank account responsibly paid all your bills on time every month and used a credit builder card to build up.

Ad Get Your 3-Bureau Credit Scores and Equifax Credit Report for 1 with 7-Day Trial Today. Find a Card Offer Now. For TTY service call 711 and ask the relay operator for 1-800-821-7232.

Find a Card With Features You Want. When you work hard to earn good credit scores you can reap wonderful rewards. No Credit Check No Deposit.

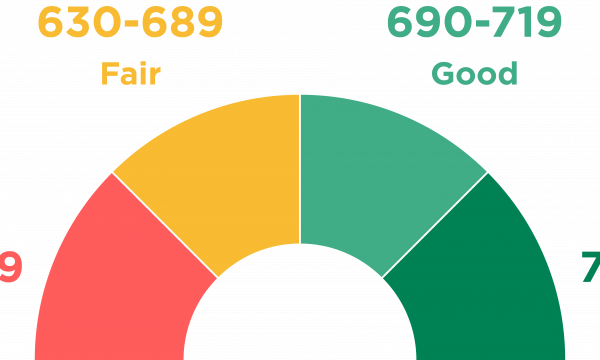

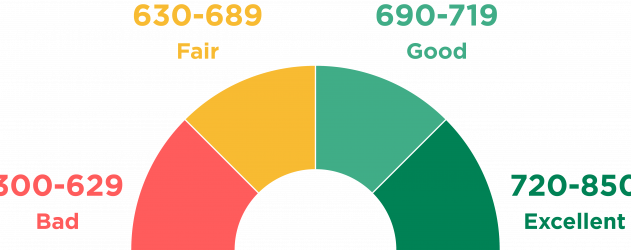

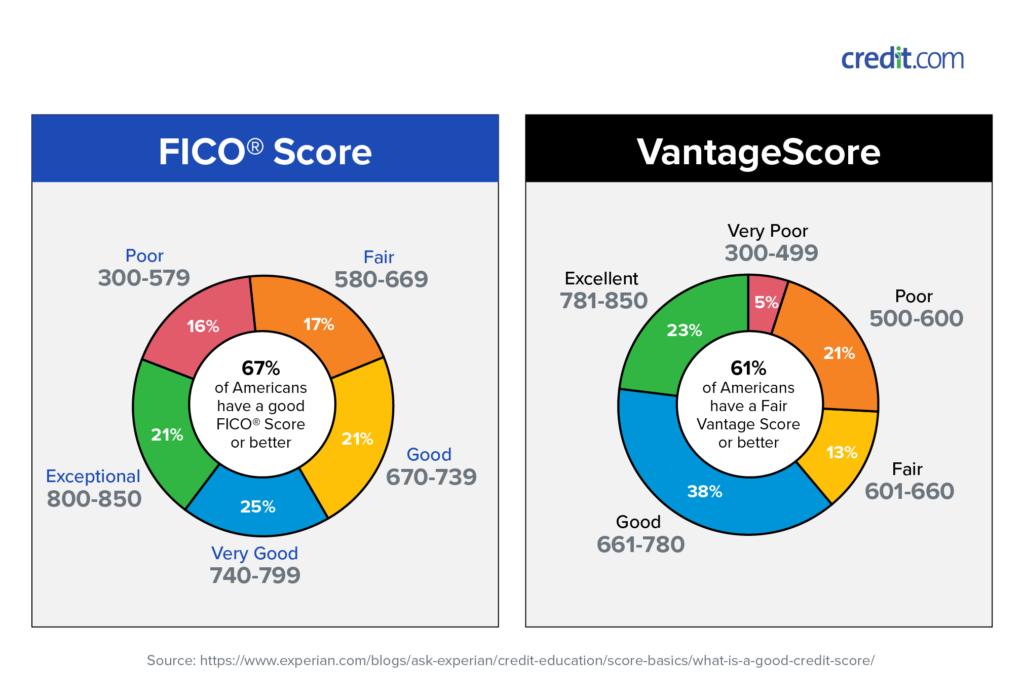

You will have to build it from the very beginning with a score of zero Learn more about how credit scores work here At first it is going to seem like you will have a hard time. Whether youre looking at a FICO Score a VantageScore or a credit score determined by a different company youll get a number that falls between 300 and 850. Your Credit Can Too.

It is an inexpensive and main. For some lenders a credit. Pick a Plan Pay Monthly to Build Credit History.

Good credit can open the door to attractive financing. This was true in 1989 and still is today. If the lender approves your application for credit it can then report your account details to any of the three main consumer credit bureaus.

As you can tell younger consumers on average have lower credit scores while older consumers have higher credit scores. Get Score Planning Report Protection Tools Now. Ad See Score Factors That Show Whats Positively or Negatively Impacting Your Credit Score.

TransUnion Equifax and Experian. Youll also want to ensure your repayment information is reported to the three main. The age group with.

Serving Over 1 Million Customers Worldwide. Experts advise keeping your use of credit at no more than 30 percent of your total credit limit. Using CreditWise to keep an eye on your credit wont hurt your score.

See Your Score Report Now. Practice good credit habits. Ad Build Your Credit With Credit Builder Visa Credit Card.

A credit score is a number that provides a comparative estimate of an individuals creditworthiness based on an analysis of their credit report. To start building credit youll need to have at least one credit account open or take out a loan. Once your credit file is created with at least one of the three major US.

Protect with Powerful Tools. Request Your Free Credit Report. The concept of credit scores started in 1989 and would evolve into todays most popular scoring model the FICO Score from Fair Isaac and Company.

Find a Card Offer Now. Ad See if Youre Pre-Approved. In the US your starting.

Get Your Credit Score Equifax Credit Report. And its free for everyone not just Capital One customers. Ad Best Credit Cards for LimitedNo Credit from Our Partners.

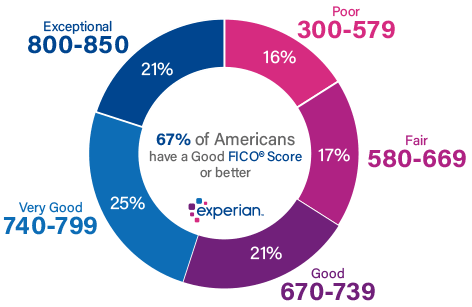

The average credit score in the US is 714 according to credit reporting company Experian calculated using the FICO scoring model. Banking services provided by The Bancorp Bank or Stride Members FDIC. Ad Get your 3B Annual Credit Scores Reports Credit Monitoring Plus a Lot More.

Ad Discover Your Credit Potential. Ad See if Youre Pre-Approved. Get More Control Over your Financial Life.

In addition to using your card youll also want to maintain a budget keep your credit utilization ratio below 10 and pay your bills on time and in full to start building a strong. Sign Up for a 30-day Trial Today. Credit bureaus it can take up to six months of payment history or more before a credit score can be.

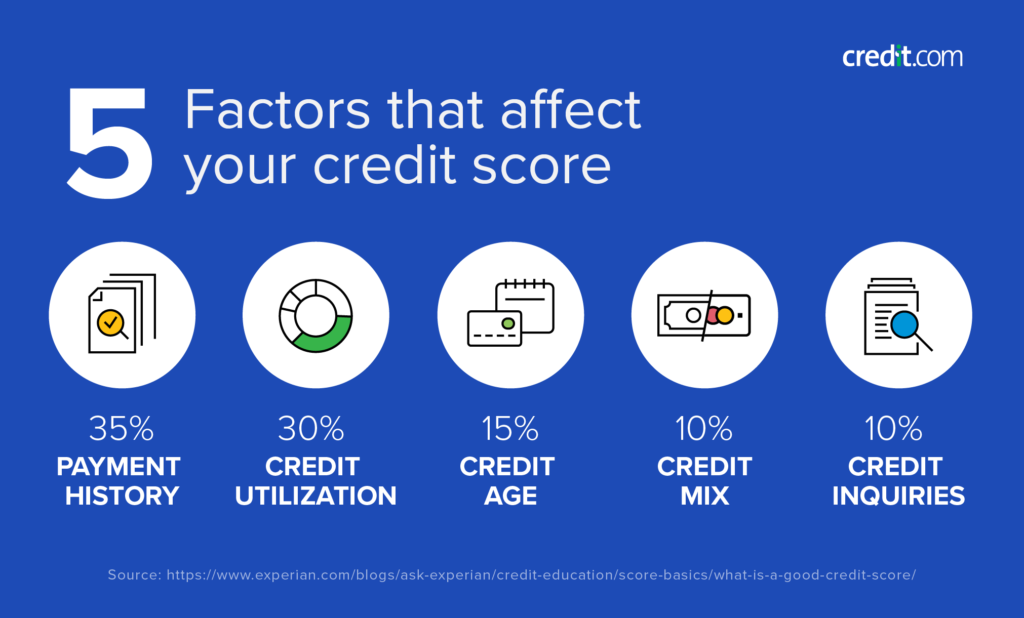

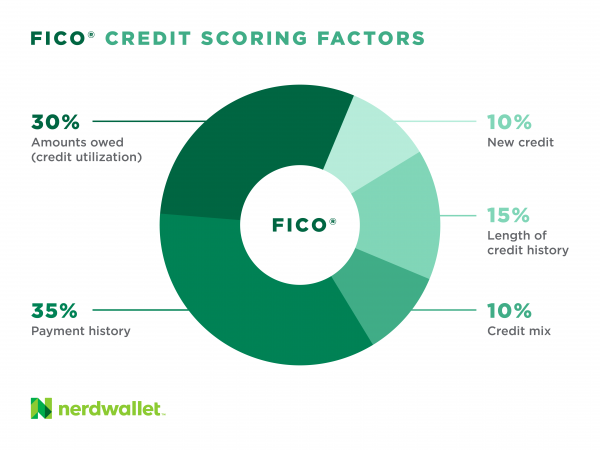

You dont need to revolve on credit cards to get a good score. You can also get free copies of your credit. Instead credit score calculations are based on five major factors.

Responsible Card Use May Help You Build Up Fair or Average Credit. Ad Build Positive Payment History with Self. Payment history 35 amount of debt 30 length of credit history 15 amount of new credit 10 and.

Find a Card With Features You Want. Earn 5 Cashback Pay 0 Fees. New Credit Scores Take Effect Immediately.

To have a FICO score you need at least one account thats been open six months or.

Average Credit Score In America 2022 Credit Score Statistics

How To Improve Your Credit Score Forbes Advisor

800 Credit Score Is It Good Or Bad

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

600 Credit Score Is It Good Or Bad

The Average Credit Scores By State Show A Staggering 62 Point Gap Forbes Advisor

No Credit Score Doesn T Mean A Zero Credit Score Nerdwallet

Fico Score 9 What You Need To Know Nerdwallet

What S Considered A Good Credit Score Transunion

Average Credit Score In America 2022 Credit Score Statistics

What Is A Credit Score What Are Credit Score Ranges Nerdwallet

The Average Credit Scores By State Show A Staggering 62 Point Gap Forbes Advisor

What Is A Fico Score And Why Should You Care Forbes Advisor

What Is A Good Credit Score Credit Score Ranges Explained

7 Steps To Improve Your Credit Score Right Now Money

What Is A Good Credit Score Credit Com

How To Improve Your Credit Score Fast Experian